Shell Risk was a new consumer protection added in 2018 that's slapped on OTC companies that are not only delinquent in filings, but also display signs of limited business operations. INQD went public in March of 2015 and opened at $1.20 per share. Their business model was centered around grow operation consultation and equipment sales, but they never picked up much steam and petered out to $0.0001 per share.So for a retard who doesn't have time to do the research, what's this mean?

Fast forwrad to May of last year and Leslie Bocskor, affectionately known as the Warren Buffet of Cannabis, is appointed CEO of the company after working with them in an advisory role since their inception. Leslie is obsessed with cannabis, and is extremely well-studied on its uses. He's been down in Mexico advising their government for the past few years on their legalization effort. And now Mexico's Supreme Court is calling for legalization, and one of our Justices is doing the same.

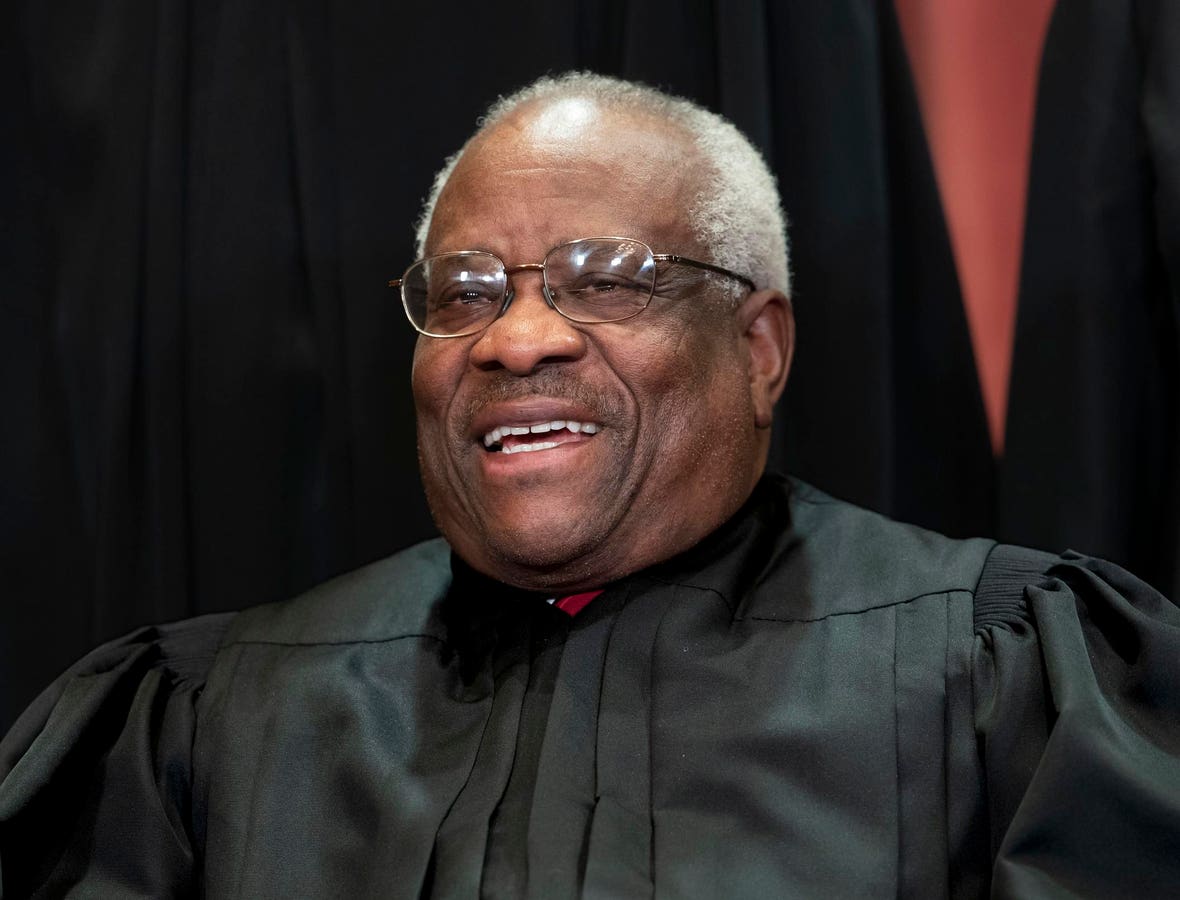

Supreme Court Justice Thomas Calling Federal Cannabis Prohibition ‘Contradictory And Unstable’ Signals Legalization Is Near

The conservative judge questioned whether the government has the authority to interfere with state-legal cannabis markets and suggested a way legalization could make its way through the Supreme Court.

www.forbes.com

www.forbes.com

So now instead of a small grow op consult firm, you've got Leslie and his grandiose ideas at the helm, which could honestly mean anything. Lately they've shifted into cannabis finance with a joint venture agreement with Finncann. A few recent interviews touched on the potential for generation-defining market shifts toward hemp as an industrial renewable resource. Using hemp for plastic production could potentially turn the entire industry into a carbon negative operation.

The stock has been holding steady at a penny for months while we all wait for them to file their audited quarterly financial statements and start dropping news. Removal of shell risk indicates OTC regulators have received "proof that financials are coming." Next step is confirmation of financials, which will then remove the Stop Sign (aka deliquent filing warning).

Indoor Harvest Corp (INQD): I also confirmed with a phone call to th...

BahamaPete: I also confirmed with a phone call to the OTC Market group and asked them the following questions; I am invested in a company, "not mentioning INQD...

After that, expect a press release from the man himself informing us on their updated business plans. Leslie has been vey tight lipped, but gently dances around the idea that fire is on the horizon. I'm not a technical trader. Nor am I a financial advisor. You'd be a fool to buy anything based on my recommendation. But there's something about this one that feels magical. At the very least there will be some fun short term gains over the next few weeks. I’m in for the long run though.

Last edited: