Welcome to our Community

Wanting to join the rest of our members? Feel free to Sign Up today.

Sign up

Feds Ask Marjorie Taylor Greene to Account for Over $3.5M of Unitemized Donations

www.newsweek.com

Between January and March, the Greene campaign received $2,558,631.61 in unitemized donations from undisclosed donors, while the campaign received another $967,045.73 in unitemized donations between April and June. The campaign reported a total of more than $4.5 million in donations during the same time period.

www.newsweek.com

Between January and March, the Greene campaign received $2,558,631.61 in unitemized donations from undisclosed donors, while the campaign received another $967,045.73 in unitemized donations between April and June. The campaign reported a total of more than $4.5 million in donations during the same time period.

Feds ask Marjorie Taylor Greene to account for over $3.5M of unitemized donations

The Federal Election Commission has given the campaign of Rep. Marjorie Taylor Greene (R-Ga.) until October 12 to provide clarification about $3.5 million in campaign contributions it received during the first half of 2021.

Treasury: Top 1 percent responsible for $163 billion in unpaid taxes

thehill.com

thehill.com

Treasury: Top 1 percent responsible for $163 billion in unpaid taxes

The U.S. loses roughly $163 billion each year in taxes owed and unpaid by the richest Americans, the Treasury Department estimated in a Wednesday blog post defending President Biden’s tax plan.

Treasury: Top 1 percent responsible for $163 billion in unpaid taxes

Treasury: Top 1 percent responsible for $163 billion in unpaid taxes

The U.S. loses roughly $163 billion each year in taxes owed and unpaid by the richest Americans, the Treasury Department estimated in a Wednesday blog post defending President Biden’s tax plan.thehill.com

What point do you think this makes, exactly?

I mean, I know you're not going to even attempt to articulate a line of reasoning, because why would you ever do that on a discussion board.

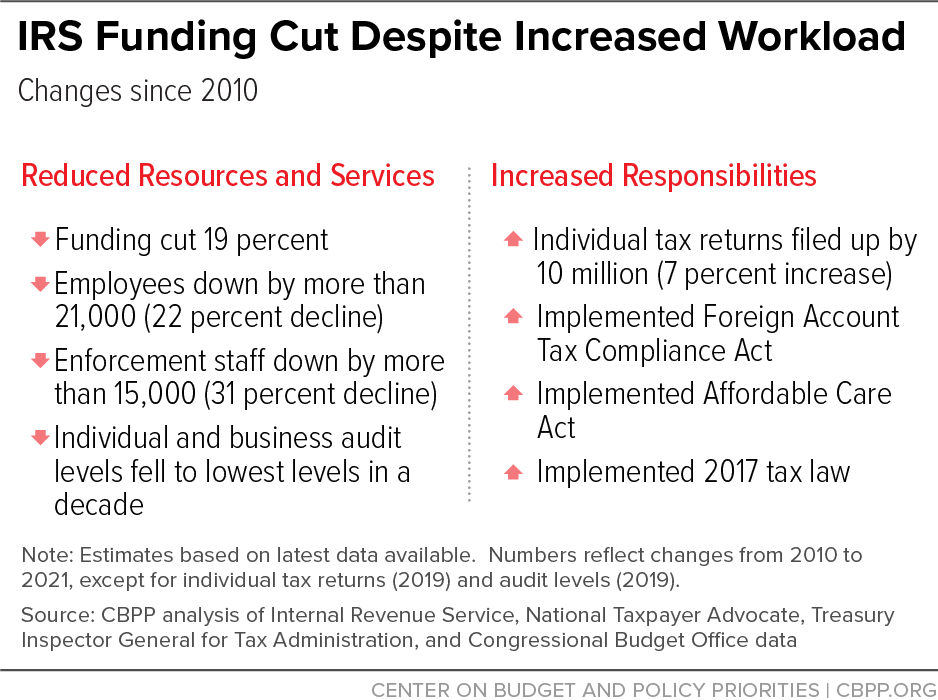

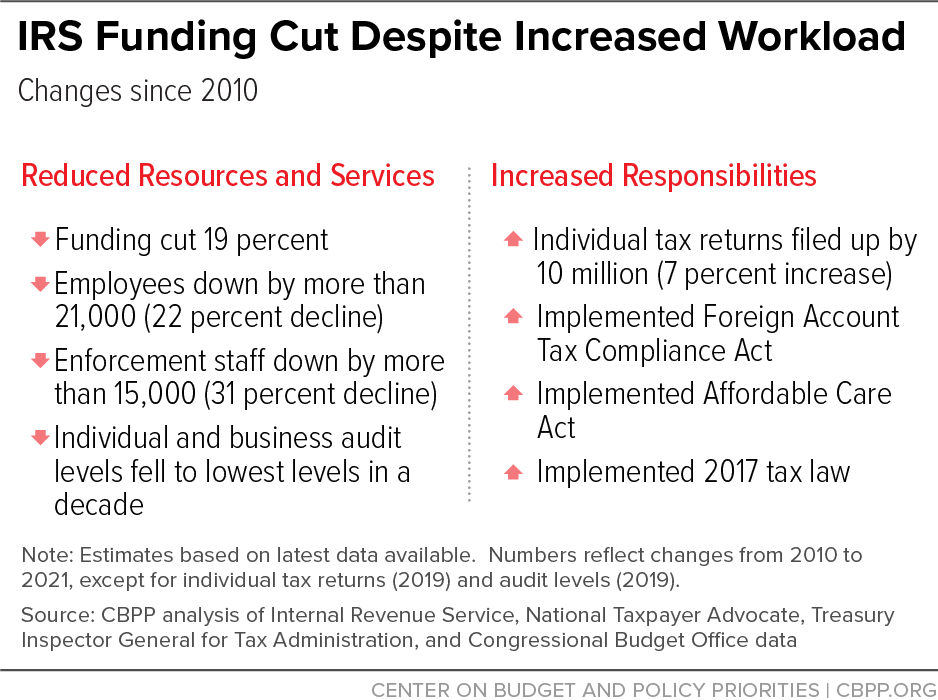

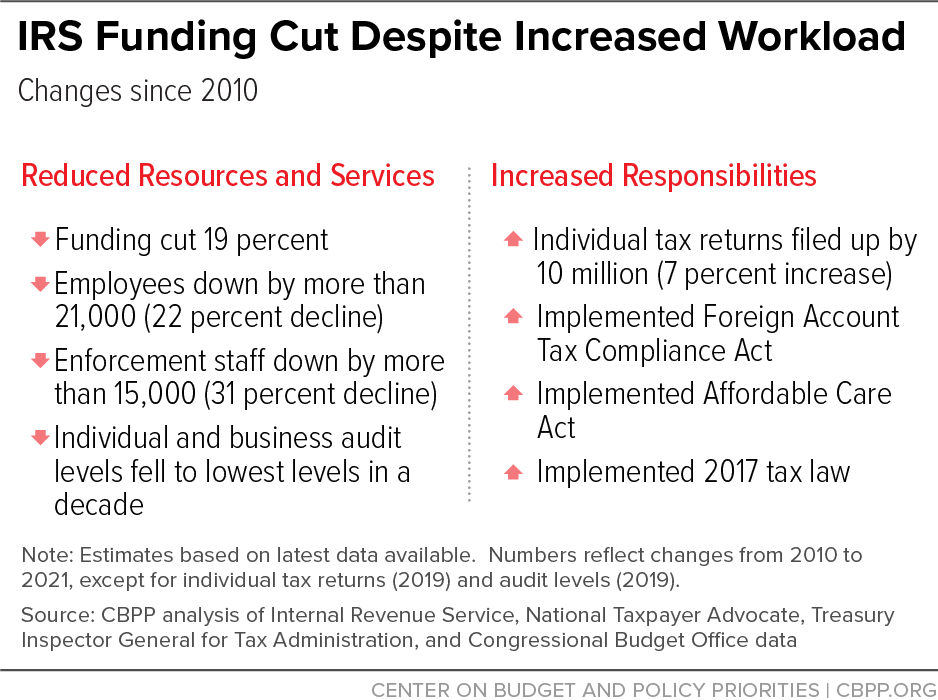

In related news that JakePaulsBeard won't so much as acknowledge, the IRS budget has been slashed by 20% in the last decade. Staff for audits and such decreased by almost a third during that time.

Think THAT might have something to do with the billionaire class skipping out on their tax obligations? Think maybe their lobbyists did this deliberately, with the enthusiastic, full-throated support of the Republicans and the tacit approval of the Democrats? And that a Sanders or Warren type might actually make positive change in that area? Naaaaaaaah, nothing to discuss there.

??

If people aren't paying their taxes now, they aren't going to start because the tax rate increases. That was the point and I thought it pretty obvious.What point do you think this makes, exactly?

I mean, I know you're not going to even attempt to articulate a line of reasoning, because why would you ever do that on a discussion board.

In related news that JakePaulsBeard won't so much as acknowledge, the IRS budget has been slashed by 20% in the last decade. Staff for audits and such decreased by almost a third during that time.

Think THAT might have something to do with the billionaire class skipping out on their tax obligations? Think maybe their lobbyists did this deliberately, with the enthusiastic, full-throated support of the Republicans and the tacit approval of the Democrats? And that a Sanders or Warren type might actually make positive change in that area? Naaaaaaaah, nothing to discuss there.

??

Billionaires aren't paying their taxes now because the IRS' enforcement abilities have been deliberately crippled by that same billionaire class - for exactly that reason.If people aren't paying their taxes now, they aren't going to start because the tax rate increases. That was the point and I thought it pretty obvious.

If the IRS has its budget and its auditing staff deliberately decimated for that very purpose, and if their computer systems are from the '90s because they've never been given money to upgrade, then no shit the enforcement of tax collection on the wealthiest citizens (who have the most complex and labour-intensive audits) will suffer.

Want to talk about that, though? Or who or what could begin to remedy it, and which party has made an active celebration of having a billionaire leader who boasts that he doesn't pay taxes, makes cheating his taxes a point of pride, and his base actually cheers how smart and awesome he is for that? In other words - want to talk about which party is proudly dedicated to making this problem worse, and which has a faction that is heavily invested in confronting it and addressing it?

Want to talk about any of that - to discuss the topic, in other words?

Nah, you don't. You just want to post stupid memes and be a trolling prick. And that's it.

That being the case - may as well just shut up and fuck off, eh? ?

??

It's already been discusses at length by me and others, I believe in this thread. The IRS chooses to pursue the easiest convictions. Upping their enforcement will only up the amount of lower class people who they pursue.Billionaires aren't paying their taxes now because the IRS' enforcement abilities have been deliberately crippled by that same billionaire class - for exactly that reason.

If the IRS has its budget and its auditing staff deliberately decimated for that very purpose, and if their computer systems are from the '90s because they've never been given money to upgrade, then no shit the enforcement of tax collection on the wealthiest citizens (who have the most complex and labour-intensive audits) will suffer.

Want to talk about that, though? Or who or what could begin to remedy it, and which party has made an active celebration of having a billionaire leader who boasts that he doesn't pay taxes, makes cheating his taxes a point of pride, and his base actually cheers how smart and awesome he is for that? In other words - want to talk about which party is proudly dedicated to making this problem worse, and which has a faction that is heavily invested in confronting it and addressing it?

Want to talk about any of that - to discuss the topic, in other words?

Nah, you don't. You just want to post stupid memes and be a trolling prick. And that's it.

That being the case - may as well just shut up and fuck off, eh? ?

??

You say this to me a lot.It's already been discusses at length by me and others, I believe in this thread.

Do you seriously expect me to trawl through six years worth of lounge posts, or six thousand posts in this thread, to check if JakePaulsBeard has ever commented on IRS budgets before?

And then go and do it again, every single time I want to reply to any post you make on any topic?

Just how fucking important do you think you are?

Yes they do, for several reasons, none of which you will address.JakePaulsBeard said:The IRS chooses to pursue the easiest convictions.

The most important being that tax returns from the billionaire class are by far the most complex, and require the most manpower and the most experienced enforcement agents.

Who are exactly the agents who have been decimated by the deliberate crippling of the IRS' ability to audit complex returns. What a coincidence, right?

By contrast, working class, paycheck to paycheck wage slaves have simple tax returns, millions of which can be processed automatically with no human even looking at them unless they're challenged.

Fair point?

And here we go. Here is the statement that kills any possible exchange. This is purely your feelings, and absolutely nothing but. You have offered no evidence to validate this statement, and you will not. Because you cannot. But if I dare to challenge it - that's it, it's over. You'll throw a little passive-aggressive temper tantrum, troll me a bit, maybe post a stupid picture, and we're done.Upping their enforcement will only up the amount of lower class people who they pursue.

??

Not if you understand how taxation enforcement works.This is extremely retarded.

It kills any possible exchange because you realize that by any logical standard it's correct. There's a reason every exchange we have results in you name calling and chanting "troll" over and over again until you end up pinked.You say this to me a lot.

Do you seriously expect me to trawl through six years worth of lounge posts, or six thousand posts in this thread, to check if JakePaulsBeard has ever commented on IRS budgets before?

And then go and do it again, every single time I want to reply to any post you make on any topic?

Just how fucking important do you think you are?

Yes they do, for several reasons, none of which you will address.

The most important being that tax returns from the billionaire class are by far the most complex, and require the most manpower and the most experienced enforcement agents.

Who are exactly the agents who have been decimated by the deliberate crippling of the IRS' ability to audit complex returns. What a coincidence, right?

By contrast, working class, paycheck to paycheck wage slaves have simple tax returns, millions of which can be processed automatically with no human even looking at them unless they're challenged.

Fair point?

And here we go. Here is the statement that kills any possible exchange. This is purely your feelings, and absolutely nothing but. You have offered no evidence to validate this statement, and you will not. Because you cannot. But if I dare to challenge it - that's it, it's over. You'll throw a little passive-aggressive temper tantrum, troll me a bit, maybe post a stupid picture, and we're done.

??

LolNot if you understand how taxation enforcement works.

M

member 1013

Guest

Keep your hands off my money, commie!!!

Did I make a single valid point in any of my responses to you in this thread over the last couple of hours.It kills any possible exchange because you realize that by any logical standard it's correct. There's a reason every exchange we have results in you name calling and chanting "troll" over and over again until you end up pinked.

Yes, or no?

??

The top 1% pay over 40% of all federal taxes collected.What point do you think this makes, exactly?

I mean, I know you're not going to even attempt to articulate a line of reasoning, because why would you ever do that on a discussion board.

In related news that JakePaulsBeard won't so much as acknowledge, the IRS budget has been slashed by 20% in the last decade. Staff for audits and such decreased by almost a third during that time.

Think THAT might have something to do with the billionaire class skipping out on their tax obligations? Think maybe their lobbyists did this deliberately, with the enthusiastic, full-throated support of the Republicans and the tacit approval of the Democrats? And that a Sanders or Warren type might actually make positive change in that area? Naaaaaaaah, nothing to discuss there.

??

You can look at that multiple ways - one of which would be the grotesque wealth disparity we have. But what you can't say is @Splinty and his sort don't pay any taxes. They do. A lot of taxes.

M

member 1013

Guest

My tax rate is 52 percent here in CanuckistanThe top 1% pay over 40% of all federal taxes collected.

You can look at that multiple ways - one of which would be the grotesque wealth disparity we have. But what you can't say is @Splinty and his sort don't pay any taxes. They do. A lot of taxes.

hands off

Absolutely you did.Did I make a single valid point in any of my responses to you in this thread over the last couple of hours.

Yes, or no?

??

I'll mysteriously disappear you so hard that when you re-emerge in public in 3 months, you'll think you're a Chinese actress.Keep your hands off my money, commie!!!

Don't think I didn't notice your very specific wording you tax cheat.

M

member 1013

Guest

I'll mysteriously disappear you so hard that when you re-emerge in public in 3 months, you'll think you're a Chinese actress.